How Acorns Can Help You Invest Wisely and Grow Your Savings

In today’s fast-paced world, finding the time and resources to manage personal finance can often feel overwhelming. Many people struggle with investing, fearing complex jargon, high fees, and market unpredictability. But what if I told you there’s a way to grow your savings effortlessly, right from your smartphone? If you’ve ever wondered, “How can I invest without feeling lost?”, then keep reading. Acorns, a leading micro-investing platform, has carved a niche for itself by simplifying investing, making it accessible for everyone, from busy professionals to students entering the financial world for the first time.

Understanding Acorns: The Future of Personal Finance

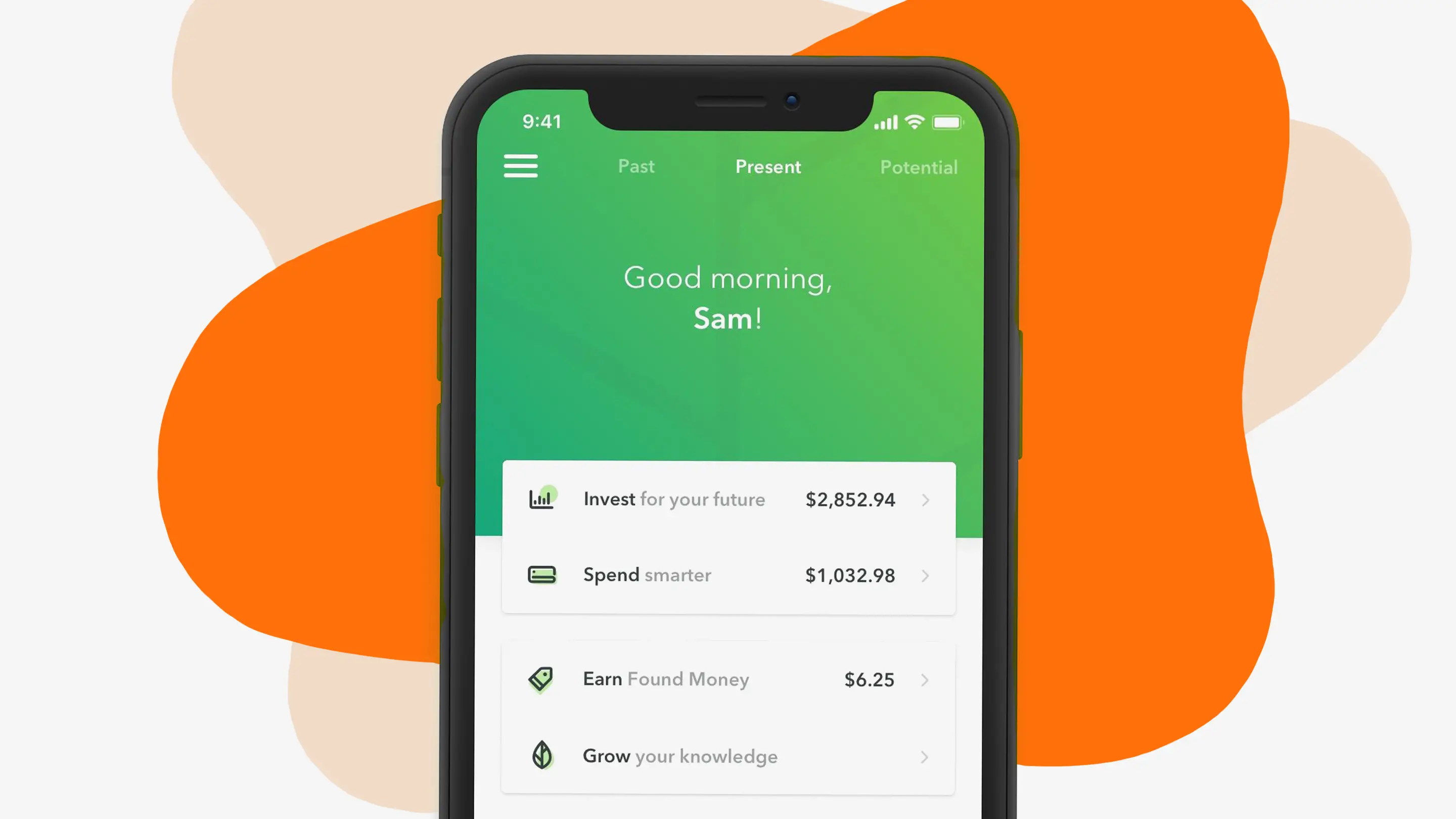

Acorns.com provides a cutting-edge solution for anyone looking to invest their spare change and grow their wealth over time. With its user-friendly interface and automatic investment features, Acorns turns everyday purchases into opportunities for growth by rounding up transactions and investing the difference. This means that whether you’re buying coffee or filling up your car, you’re also investing in your future.

Who is Acorns For?

Targeted towards millennials, first-time investors, and anyone interested in wealth-building without the burden of hefty management fees, Acorns appeals particularly to those with busy lifestyles who might lack the time to focus on market trajectories. You don’t need to be wealthy or financially savvy to start investing; you can begin with as little as $5. The platform’s mission is to make investing easy and approachable for everyone—no matter your financial background.

Primary Long-Tail Keyword

The primary long-tail keyword here is “invest wisely”.

Secondary Keywords

The two secondary keywords include “grow your savings” and “micro-investing”. With these keywords, we can further highlight the benefits Acorns brings to users seeking to improve their financial health.

1. The Value of Micro-Investing for Everyone

Micro-investing has emerged as a savvy solution for building wealth without disrupting your daily life or budget. Acorns epitomizes this movement, allowing users to invest their spare change seamlessly. Here are some actionable insights into how you can utilize the Acorns platform to grow your savings effectively:

a. Round-Up Investments

Acorns’ round-up feature automatically rounds up your everyday purchases to the nearest dollar. For example, if you spend $3.50 on a latte, the extra $0.50 gets invested into your chosen portfolio. This is a powerful tool that allows anyone to invest without feeling the pinch of an immediate financial outlay. Over time, these small amounts can add up significantly and contribute to wealth accumulation.

b. Diversification with Ease

One of the standout features of Acorns is how it diversifies your investments based on your goals and risk tolerance. By filling out a short questionnaire, Acorns tailors a portfolio that spans multiple asset classes, ensuring balanced growth. This diversification can minimize risk and promote long-term gains—a crucial step if you want to invest wisely.

c. Educating Yourself Through the App

Acorns doesn’t just stop at investing—it also seeks to educate its users. With in-app features like Acorns Grow, you’ll have access to a wealth of financial literacy content, podcasts, and videos to help you understand investment principles better. Investing wisely includes understanding what you’re investing in, and Acorns places a strong emphasis on consumer education.

d. Automatic Rebalancing

No need to constantly monitor your portfolio. Acorns automatically rebalances your investments to keep them aligned with your financial goals. This means you don’t have to become a financial expert to ensure your investments perform optimally; Acorns does the work for you.

2. A Story of Transformation With Acorns

Imagine Sarah, a millennial living in a bustling city, who often lamented about not being able to save for her dream home due to rising living costs. With her busy schedule, she found it challenging to dedicate time for budgeting and investment planning. One day, after a conversation with her friends about personal finance, she decided to download Acorns.

From the very first purchase she made, she saw the benefits of the round-up feature. Sarah vividly recalls the moment she received the notification, “You just invested $1.25!” It sparked a sense of excitement in her—savings that previously felt stagnant were now growing, even amidst her seemingly endless expenses.

The Emotional Benefits

As weeks turned into months, Sarah found herself not only gaining confidence in her financial decisions but also becoming more engaged with her investments. She started setting small financial goals—saving for that down payment, and even planning a vacation! Acorns made her feel empowered to take control of her financial future with minimal effort.

Through regular savings—resulting from mere daily transactions—Sarah realized that investing wisely didn’t have to feel unattainable. The convenience and accessibility Acorns provided helped Sarah transform her financial situation from anxiety-laden to hopeful—and inspired others in her circle to consider investing through Acorns as well.

3. Acorns’ Strengths and Considerations

As with any investment platform, it’s essential to weigh both strengths and minor drawbacks before committing fully.

Strengths of Acorns

- User-Friendly Interface: Acorns is straightforward, making it easy for anyone to start investing without a steep learning curve.

- Effective Educational Resources: The platform offers ample support through tutorials and articles that help users navigate and understand personal finance.

- Affordable Investment Starting Points: With a mere $5 to start, there’s no intimidating entry barrier for prospective investors.

Minor Drawbacks

- Limited Customization: While Acorns offers unique investment portfolios, users might find their options limited compared to full-service investment platforms that allow for specific stock purchases.

- Monthly Fees: Depending on the account value, users might experience monthly fees that could eat into their profits if their balances are relatively small. However, it’s worth noting that these fees can be outweighed by the compound growth over time.

Comparative Analysis

When compared to traditional brokerage firms, Acorns shines in terms of making investing accessible to the everyday consumer. However, for seasoned investors seeking advanced strategies or stock specificities, they might gravitate towards platforms offering more control. Acorns is more suited for those starting their investment journey, specifically micro-investing, making it an ideal stepping stone for financial growth.

4. Real Customer Testimonials

Here are some authentic experiences shared by satisfied Acorns users that highlight the platform’s versatility:

Testimonial 1: David - The Busy Professional

“I never thought I could invest because my budget is tight, but Acorns made it easy! I forget it’s there, but then I see my account grow. It’s like a savings account that earns more over time!”

Testimonial 2: Priya - The New College Grad

“Acorns changed my perspective on my first paycheck! With their round-up feature, I’m able to invest without thinking about it, and I’m already saving for grad school!”

Testimonial 3: Mike - The Family Man

“With kids and bills, I thought investing was out of reach. But small investments truly add up. I’ve encouraged my wife to get on board, and we both feel empowered about our family’s future.”

Testimonial 4: Jenna - The Aspiring Entrepreneur

“I’m starting my journey into personal finance, and Acorns made it seem doable. I love how it educates while I invest, so I feel much more confident about my choices.”

Testimonial 5: Tom - The Retiree

“I wanted a simple way to manage my travel savings. I set it up and forgot about it! Now it’s nice to see those numbers stack up for that dream trip to Europe!“

5. Expanding the Use Cases for Acorns

Acorns isn’t just for young investors. It has various benefits that appeal to different demographics, building deep trust and reliability among users.

Family Savings Plan

Families can utilize Acorns to create an investment account for their children, setting them up for future financial success. By rounding up purchases and directing those funds into the child’s account, parents can gift financial wisdom alongside monetary gifts.

Retirement Funding

For individuals approaching retirement, Acorns offers options to create a safe and growth-centric investment strategy. The platform’s approach to auto-rebalancing and diversified investments can provide peace of mind, ensuring that one’s retirement savings are well-managed and growing.

Special Projects or Education Funds

As a versatile platform, investors can earmark investments for personalized projects or education needs—be it a wedding, higher education costs, or travel aspirations, making Acorns a well-rounded solution for financial foresight.

Conclusion: The Smart Investment You Were Looking For

In an unpredictable world, finding a reliable method to invest wisely is crucial for securing your financial future. Acorns stands out due to its unique offerings that appeal to a diverse audience—from daily shoppers looking to save for a rainy day to ambitious youngsters hoping to learn and grow their financial expertise. Its engaging platform empowers users every step of the way.

Ready to see the difference it can make in your life? Visit Acorns.com and start to grow your savings today with the convenience of innovative micro-investing.

What’s your experience with investing? Let us know below!

Authentic User Reviews

Duane Deloney (Trustpilot)

Rating: 5/5 | Date: 2025-03-20

Easy to manage, helpful insights available to educate me on investing. View Original Review

Anthony Malcolm (Trustpilot)

Rating: 5/5 | Date: 2025-03-19

The app itself being so user friendly made it a great experience easy to understand and I think that the acorns team does a great job in managing investments in the app also the online agent that I spoke to was very knowledgeable and quick to resolve my issues. View Original Review

Victor Inwang (Trustpilot)

Rating: 5/5 | Date: 2025-03-19

Acorns has proven to a good app with good features. I particularly enjoy the convenience for savings and ability to make money through referrals for friends and people to be able to join in the acorn community View Original Review

Rosalinda Ybarra (Trustpilot)

Rating: 5/5 | Date: 2025-03-19

Great way to set some money aside. I can pause the withdrawal of the Roundups when I won’t have enough money in the bank. View Original Review

Kathleen White (Trustpilot)

Rating: 5/5 | Date: 2025-03-18

Zàrra was great! View Original Review

Renee Groce (Trustpilot)

Rating: 5/5 | Date: 2025-03-18

Acorn gives me valued information regarding the market and how it works. For anyone who is interested in saving for their future, Acorn gives a very easy detailed approached to it. I’m a young senior, as I like to call myself and it’s never to late to learn and grow. Thank you Acorn for letting me grow my oat. View Original Review

CoolCash (Trustpilot)

Rating: 5/5 | Date: 2025-03-18

The service and options have been more than I expected!

Thanks!!! View Original Review