Unlock Your Financial Freedom with Credit Firm: The Best Credit Repair Services

Everyone’s heard the conventional wisdom: a good credit score opens doors. But have you ever stopped to think how many opportunities you might be missing due to a less-than-stellar credit score? According to recent studies, approximately 30% of Americans have a credit score below 600, which can significantly hinder their chances of securing loans, homes, or even rental agreements.

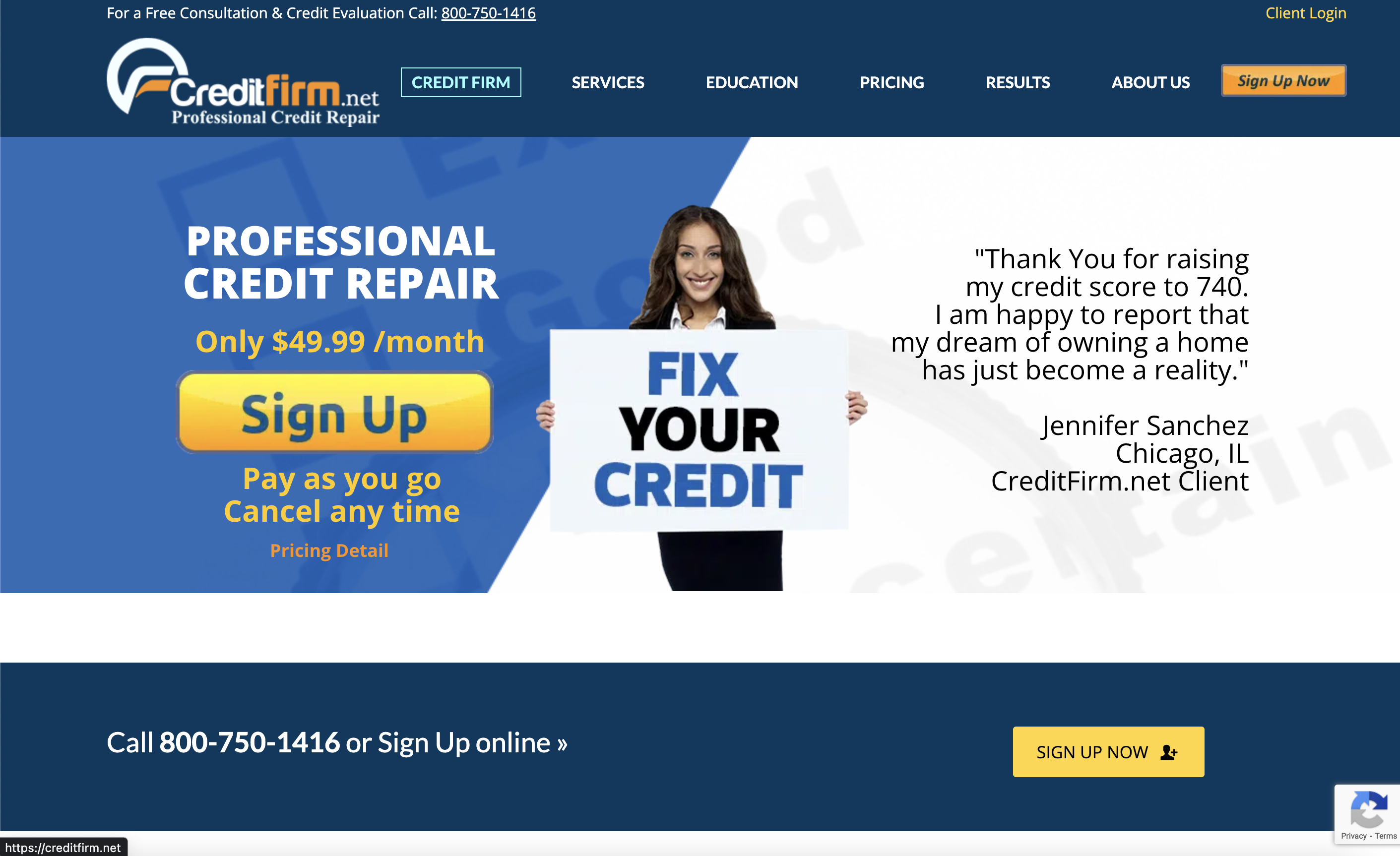

If your credit report leaves much to be desired, you may feel paralyzed by inaction. People often ignore their credit issues or settle for untrustworthy solutions. But what if there was a trustworthy partner that could help you navigate the complex world of credit repair? Enter Credit Firm, a leading service that specializes in helping consumers reclaim their financial health through efficient credit repair strategies.

Understanding Credit Repair: Why It Matters

Before we delve into how Credit Firm can assist you, it’s essential to understand the basics of credit repair. Credit repair is the process of reviewing your credit report, identifying inaccurate information, and taking steps to remove or amend these inaccuracies.

But why should you care about fixing your credit? A robust credit score can lead to better interest rates on loans, easier access to mortgages, and even enhance your chances of employment. In fact, some employers factor your credit score into their hiring decisions, believing it to be an indicator of your responsibility.

If you’ve ever found yourself wondering, “How can I improve my credit score?” or “What steps should I take for credit repair?”, rest assured that the solutions are more accessible than you think, especially with Credit Firm at your side.

Actionable Tips for Repairing Your Credit Score

When looking to repair your credit, it’s crucial to know the steps you need to take. Here are several actionable tips that align perfectly with what Credit Firm offers:

Request Your Credit Report: Did you know that everyone in the U.S. is entitled to a free credit report once a year from the three major credit bureaus? Start by checking your report for discrepancies and unauthorized accounts.

Dispute Inaccuracies: If you find errors on your credit report, follow Credit Firm’s systematic approach to disputing these inaccuracies for a better score. Simply flag the inaccuracies, and Credit Firm can advise you on how to proceed with disputing them to the credit bureaus.

Pay Your Bills on Time: Consistent, on-time payments contribute greatly to your credit score. Credit Firm emphasizes the importance of financial discipline, along with strategies for setting up automated payments for bills.

Lower Your Credit Utilization Ratio: Strive to maintain your utilization ratio below 30%. Credit Firm will guide you in creating a budget, helping you to avoid overspending relative to your credit limits.

Avoid New Hard Inquiries: Be cautious about applying for new credit; hard inquiries can slightly dent your score. Credit Firm advocates for strategic planning when seeking new credit opportunities.

Implementing these strategies not only aids in immediate improvements but aligns with a long-term commitment to maintaining good credit habits.

A Day in the Life: Transformation with Credit Firm

Imagine waking up one day, finally free from the relentless burden of poor credit. Meet Jessica, an ordinary American who found herself trapped in a cycle of missed opportunities because of a low credit score.

Jessica was ready to buy her first home but quickly realized that her score of 580 stood in her way. After a frustrating attempt to tackle the issue alone, she turned to Credit Firm, seeking professional guidance. What followed was nothing short of a transformation.

In just a few months of working with Credit Firm’s experts, Jessica engaged in a tailored program designed to identify and resolve her specific issues. She discovered that errors on her report had cost her points—errors that were swiftly corrected by Credit Firm.

Here’s how the process unfolded:

- Credit Review: Credit Firm conducted a comprehensive analysis of Jessica’s credit report to identify negative items.

- Dispute Process: They prepared and submitted disputes to each credit bureau on Jessica’s behalf, advocating for her rights.

- Financial Coaching: Beyond just repairs, Credit Firm educated Jessica on budgeting skills, ensuring her improved score would last.

- Monitoring: They also offered ongoing credit monitoring to help Jessica stay on track in the aftermath.

After a few months of dedicated work, Jessica watched her score rise to an impressive 720. Empowered, she applied for her home loan and secured not just approval but at a lower interest rate than she had anticipated. Now, she is a proud homeowner, celebrating her new beginning. What doors could open for you if your credit score improved?

Weighing the Pros and Cons: A Balanced View

No service is without its strengths and weaknesses, and Credit Firm is no exception. Here’s a detailed overview of the pros and cons:

Strengths:

- Expertise: Credit Firm has a team of seasoned credit repair specialists who understand the ins and outs of the industry.

- Comprehensive Services: From disputes to financial consulting, they offer a one-stop solution for all your credit repair needs.

- Customer Satisfaction: Many testimonials and reviews illustrate their commitment to helping clients succeed.

Drawbacks:

- Cost: For some, the expense of credit repair services can be a barrier; however, it’s essential to consider this an investment in your financial future.

- Time Investment: Credit repair does take time, and improvements will vary based on individual circumstances. While some may see results quickly, others may need to exercise patience.

In comparison to other credit repair services that often cut corners or offer little personalization, Credit Firm stands out by tailoring services that meet their clients’ unique needs. Notably, their educational approach not only addresses rectifying errors but also empowers individuals to build their credit responsibly long term.

Real Voices: Customer Experiences

The true litmus test of any service is in the voice of its users. Let’s take a look at what some satisfied customers have said about their experiences with Credit Firm:

- Mark T.: “I was skeptical at first, but Credit Firm truly exceeded my expectations. They cleared a significant error off my report that I thought would be impossible. I’m now on track to buy my first home!”

- Linda P.: “My credit was a mess after missing payments during tough times. With Credit Firm’s guidance, I learned to be responsible with my finances, and they helped remove negative items from my report. Highly recommend!”

- Derek J.: “The team at Credit Firm really cares. They not only fixed my credit but taught me the actual impacts of utilizing credit. I feel empowered now!”

- Jessica A.: “From start to finish, it was clear Credit Firm was on my side. Their communication was excellent throughout the process. I felt valued!”

- Tom K.: “I tried other credit repair services before Credit Firm with little success; they made all the difference, and now my score has improved significantly in just a few months.”

These testimonials highlight a strong consensus: Credit Firm is recognized for its commitment to customer care, personalized attention, and effective practices leading to tangible results.

Broader Applications: Beyond Credit Repair

While Credit Firm is primarily focused on credit repair, its benefits extend well beyond improving your credit score. Consider these additional use cases:

- Loan Approval Assistance: Preparing for loan applications by ensuring your credit profile is strong, ultimately securing funding faster.

- Financial Planning: Credit Firm’s core values include empowering clients to plan their finances, extending to budgeting advice, savings guidance, and investment tips.

- Identity Theft Recovery: Should you fall victim to identity theft, Credit Firm’s support can guide you through the recovery process, addressing any damage done to your credit profile.

- Credit Education: They provide resources and tips that help users understand credit better, enabling informed future decisions.

By thinking beyond just credit repair, you can see how Credit Firm acts as a partner in comprehensive financial wellness.

Conclusion: Your Path to Financial Freedom

Taking the reins of your financial future may feel daunting, especially when your credit score hangs in the balance. But with Credit Firm’s expert services, you’re not alone on this journey. From identifying errors on your credit report to empowering you with strategies for lasting habits, the tools are at your fingertips.

Isn’t it time to break free from the chains of poor credit? Rediscover the opportunities that await you. Ready to see the difference? Visit creditfirm.net and take the first step towards a brighter financial future.

Interactive Prompt

What strategies have you tried for improving your credit score? We’d love to hear your experiences! Feel free to share in the comments below.

Authentic User Reviews

Ryan Jensen (Trustpilot)

Rating: 5/5 | Date: 2025-03-02

Documenting My Credit Repair Journey… Documenting My Credit Repair Journey with Credit Firm

** Scroll to bottom for most recent update**

Review Jan 14, 2025:

I recently signed up with Credit Firm to help repair my credit and wanted to document my journey to provide transparency and updates for others considering their services.

I’ve been working on improving my credit for some time, and after researching various companies, I chose Credit Firm due to their straightforward pricing and solid reputation. Within just a day of signing up, they confirmed that my dispute letters were sent out—a promising start!

For context, here are my starting credit scores: • TransUnion: 615 • Experian: 611 • Equifax: 625

My primary goals include removing negative accounts from my credit report (such as OpenSky, Infiniti, and Verizon) and improving my overall credit profile. I’ll be documenting my progress here over the coming weeks, sharing updates about the process and results to help others make informed decisions about Credit Firm.

So far, I appreciate the responsiveness and quick action from the team. I look forward to seeing how they handle my case and the impact it has on my credit scores.

Stay tuned for updates!

Update Feb 24, 2025:

One item was removed from my reports so far. Not sure if I could have achieved this by sending out the letters but so far I am very happy with my experience. Communication has been personalized and prompt, <24 hour turn around each time I’ve reached out.

Scores: • TransUnion: 721 • Experian: 709 • Equifax: 699

Going into my 2nd month of service I am satisfied thus far and would recommend. We will see if any effort is made this month or if the service simply sends the initial batch and sits back. Stay posted! Upgrading to 5/5 stars for now! View Original Review

Realtor Michael (Trustpilot)

Rating: 5/5 | Date: 2024-10-22

I’ve been sending clients to credit firm for about 3 or 4 months and have started seeing some great results. Clients are coming back with higher credit scores, fewer collections, charge offs, etc… and much more ready for a mortgage. I’ve referred clients to other credit repair companies before and it got or miss but, I really like what I’m seeing from credit firm so far. View Original Review

Nina Tebet (Trustpilot)

Rating: 5/5 | Date: 2024-09-07

Absolutely wonderful, I signed up on July 15th 2024 and have already seen 4 accounts removed and my scores are all up over 640 already. View Original Review

Max Monologue (Trustpilot)

Rating: 5/5 | Date: 2024-08-11

Signed up in June and my scores have all gone up, they even got the eviction collection off my reports View Original Review

Lyn (Trustpilot)

Rating: 5/5 | Date: 2022-06-07

I had my identity stolen a few years ago and have been trying to clean things up over the course of the last year and a half but, the credit card companies and credit bureaus and not been very helpful. I finally decided to hand things off to a professional service and I went with CreditFirm.net because of the great reviews. They did not disappoint. What I couldn’t accomplish for 18 months took them 3 months to do and they had all of the fraudulent accounts removed. I just wish I did this sooner. View Original Review

Joe Cooper (Trustpilot)

Rating: 5/5 | Date: 2022-05-25

I used credit firm in 2013 to fix my credit and everything was great but, everything went sideways a few years ago because of covid. I got a bunch of late payments and medical bills on my credit so I had to use them again. My scores are a lot better now and the medical bills are all gone. CreditFirm.net did a great job but, I hope I never have to use them again but, it’s still nice to know that I have someone to help me when I need it View Original Review

D-Rob (Trustpilot)

Rating: 5/5 | Date: 2022-05-10

I’m usually not one to write reviews but, after neglecting my credit for years I finally had the courage to take a look at my credit report and I was in complete shock. So much stuff I didn’t even know existed. Old debt for Comcast, AT&T, an apartment complex I left because they had roaches, car insurance, medical, so much!!!! Pages and pages of companies I’ve never heard off all saying that I owe the money. Made my head spin. I was going to let it go but, I decided that I was going to do something about my scores once and for all. I signed up a few months ago with creditfirm.net and although we’re not done yet, we’re making great progress. I had 17 accounts removed so far and my scores are starting to go up. I know that there’s a lot more work to do and that this process takes time but, for the first time in a while I have hope, hope that things will be better, and I have faith in creditfirm. God bless you, the work that you do is so important, thank you for helping me! View Original Review

Donald Penn (Trustpilot)

Rating: 5/5 | Date: 2022-04-20

Started with this company because of the low price and expected them to drag their feet for their monthly payments but, surprisingly enough they disputed every negative account I had in the first month (there were over 40 on each bureau), and even sent letters to the collection agencies which got a whole lotta stuff deleted. Credit Firm removed more accounts in 2 months than Lexington Law did in the 6 months I was with them. Lexington was disputing 3 or 4 accounts at a time and was charging me $120 a month, CreditFirm disputed EVERYTHING for $50 a month! If you’re going to get a company to fix your credit, do yourself a favor and give CreditFirm a shot. They are sooooo much better and faster. View Original Review

A. Pliev (Trustpilot)

Rating: 5/5 | Date: 2022-04-08

Just signed up a week ago and I’m already starting to receive notifications from Experian that accounts are being removed. 2 collections down, 7 more to go. Let’s go boys!!! View Original Review

Dessert Fox (Trustpilot)

Rating: 5/5 | Date: 2022-02-11

Let’s be real, I could have done all this myself for free, but I don’t have the time or motivation to sit here, write these letters, follow up, and deal with all this nonsense. I got these guys to do the work for me and to be honest, I don’t regret it for one moment. I could have saved a few hundred bucks doing this stuff myself but, I work enough at my job and don’t need to be on the clock when I get home. Credit Firm did all the work for me and removed a bunch of debt from my reports. Scores went up, well worth it. View Original Review