Unlock Your Financial Potential: The Best Financial Management App

Managing finances can often feel like navigating a minefield. You start with good intentions, diving into budgets, savings plans, and investment opportunities, only to find yourself overwhelmed and unsure of where to go next. Does this sound familiar? In today’s fast-paced world, we all require tools that not only help us achieve financial stability but also remove the clutter and confusion that often come with it.

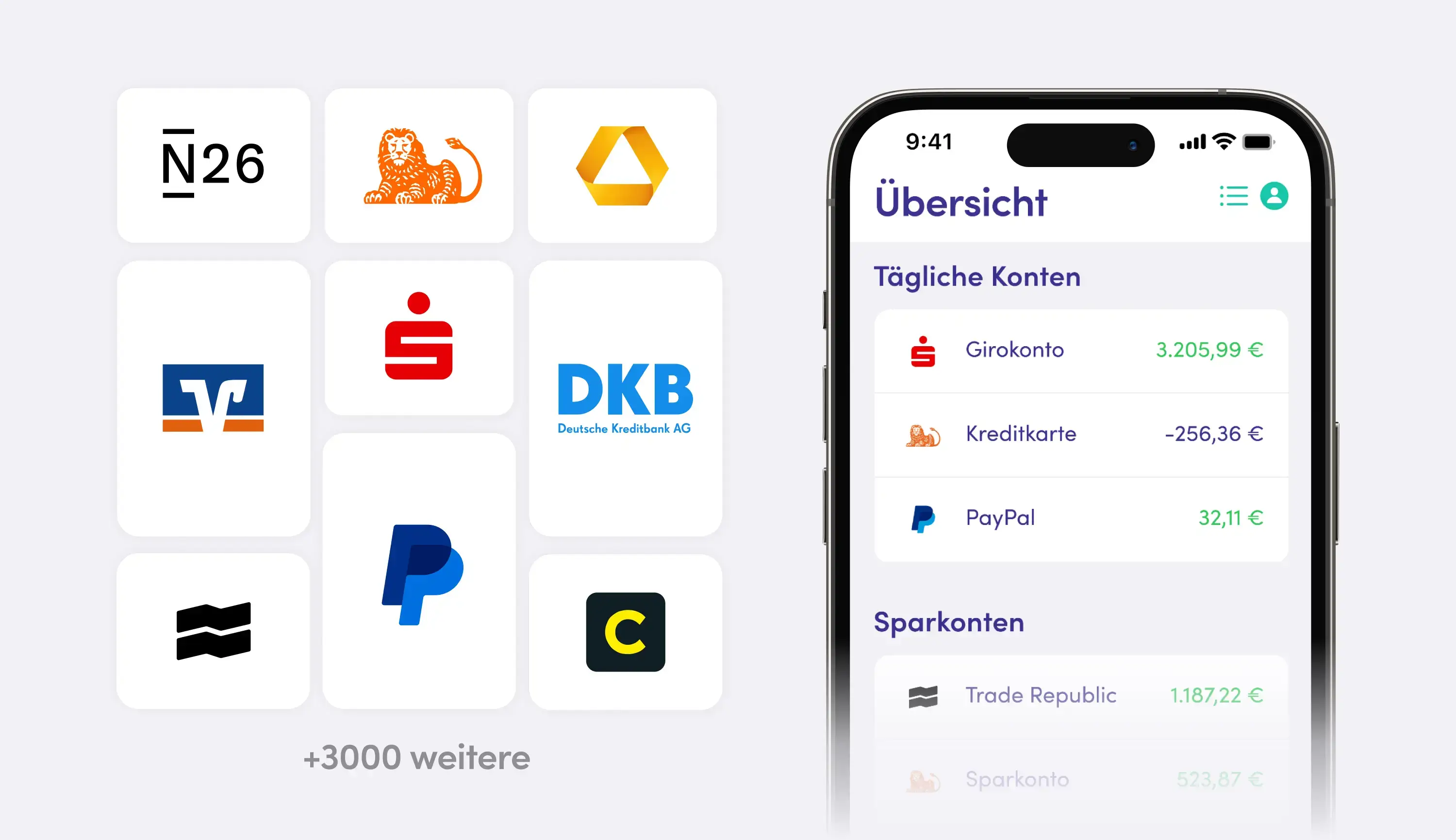

This is where finanzguru.de steps in, a remarkable financial management app designed to guide users through their financial journey effortlessly. Whether you’re a busy professional trying to juggle expenses or a newly independent individual eager to establish sound financial habits, finanzguru provides exactly what you need. This comprehensive guide will delve into the features, benefits, and tremendous value of using finanzguru, helping you unlock your financial potential.

Section 1: Mastering Your Finances with Actionable Insights

When it comes to financial management, the key lies in being proactive rather than reactive. Here are several tips and insights to make the most of your finances, particularly through the capabilities offered by the finanzguru app:

Automate Your Budget: One of the standout features of finanzguru is its ease of use in automating your budget. By linking your bank accounts, the app provides real-time updates on your spending habits and offers insights on where you can cut back. Imagine receiving notifications that help you recognize spending patterns, enabling you to make informed decisions.

Set SMART Goals: By using the app’s goal-setting feature, you can establish Specific, Measurable, Achievable, Relevant, and Time-bound financial objectives. Perhaps you aim to save for a dream vacation or pay off debt. Setting clear goals can make the journey tangible and rewarding.

Utilize Financial Analytics: The app offers data visualization tools that help you understand your financial health over time. No more guessing! With clear graphs and insights, you can see how slight changes in spending can substantially impact your savings and investments.

Stay Informed About Financial Products: The app provides recommendations for financial products tailored specifically to your needs. Financial jargon can be daunting, but with finanzguru’s clear suggestions, you’ll feel empowered to choose smarter savings accounts, credit cards, or loans.

- Regular Reviews: Schedule reviews of your financial health within the app. Implement monthly check-ins to track progress and adjust goals as necessary, ensuring that your financial journey remains aligned with your evolving needs.

By integrating these actionable tips with the features of finanzguru, you will find that taking control of your finances becomes not just achievable but also enjoyable.

Section 2: A Relatable Journey with finanzguru

Imagine a recent college graduate named Sarah. With a new job in her pocket and student loans looming over her, she understandably felt overwhelmed. She tried budgeting using spreadsheets, but keeping track of expenses was a nightmare.

That’s when a friend introduced her to finanzguru.de. Hesitant at first, Sarah decided to give it a try. After linking her bank account, she was pleasantly surprised by the app’s intuitive design and user-friendly interface.

Within the first week, Sarah received alerts about unnecessary subscriptions she had forgotten about, which saved her a significant amount of money. The budgeting feature offered her a panoramic view of her spending categories, revealing she spent way too much on coffee runs. Armed with this knowledge, she began crafting a financial plan that balanced her spending and saving efficiently.

Weeks turned into months, and Sarah not only paid off a portion of her student loans but also found herself saving for her first trip abroad. Thanks to finanziur, she turned financial chaos into a pathway for growth and empowerment. Sarah’s story is a testament to the difference financial management can make.

Section 3: Strenghts and Minor Drawbacks

While every product comes with its unique strengths, it’s essential to recognize minor drawbacks as well, and this helps in providing a balanced view.

Strengths:

- User-Friendly Interface: The app’s clean, intuitive design makes navigation a breeze, even for those less technologically savvy.

- Automated Insights: Real-time notifications keep you informed about your spending habits, which is a significant motivator for change.

- Goal-Oriented Features: The focus on setting and tracking financial goals helps users remain dedicated to their objectives.

- Personalized Recommendations: Based on user financial health and goals, it suggests products that may enhance their financial journey.

- Robust Security: Financial data is sensitive, and finanzguru ensures high-level security measures so users can manage their finances without worry.

Minor Drawbacks:

- Limited Banking Options Initially: While the app is rapidly expanding its bank partnerships, some users might find limited connectivity at the onset.

- Premium Features: Some of the app’s more advanced features may be locked behind a premium payment option, which some users might find restrictive.

In summary, while finanzguru shines in its user experience and features, potential users should be aware of its current limitations. However, the pros considerably overshadow the cons, making it an excellent choice for anyone aiming to navigate their finances effectively.

Section 4: Experiences & Testimonials

1. Tom’s Transformation

“I was struggling with managing my expenses until I tried finanzguru. Now, I feel in control and have set the goal to save for a house!”

— Tom, 28, Graphic Designer

2. Mia’s Monthly Savings

“The budgeting feature has changed my life! I saved over €200 last month by simply keeping track of my monthly spendings.”

— Mia, 34, Marketing Specialist

3. Lucas’ Student Loan Journey

“As a recent graduate, I was lost with my student loans. Thanks to finanzguru, I now have a clear repayment plan and even a savings strategy!”

— Lucas, 24, Recent Graduate

4. Emma’s Financial Confidence

“I never thought managing finances could be easy! The insights I get from the app are invaluable — I plan to send my kids to college without debt!”

— Emma, 39, Stay-at-home Parent

5. Alex’s Investment Journey

“Thanks to personalized recommendations, I’ve begun investing with confidence! I never knew where to start, but now, I feel equipped.”

— Alex, 31, Tech Consultant

These testimonials highlight the myriad of ways individuals benefit from using finanzguru, bringing the app’s value to life through real-world experiences.

Section 5: Beyond Budgeting: Other Benefits of finanzguru

While budgeting is a significant part of the finanzguru app, it’s essential to highlight other benefits that broaden its appeal:

- Enhanced Financial Literacy: The app not only provides insights but also educates users about financial concepts, enhancing their overall understanding.

- Investment Tracking: Users can link their investments, track their performance, and receive alerts for any significant changes, taking the guesswork out of investing.

- Financial Wellness Resources: Users benefit from access to expert articles and resources aimed at improving their financial wellness, including tips on saving, investing, and debt management.

- Integration with Financial Advisors: For those looking for personalized advice, the app offers options to connect with certified financial advisors to guide them according to their unique situations.

- Community Engagement: Users can engage with a community of like-minded individuals, sharing tips and celebrating financial milestones together.

All of these features go beyond mere budgeting, providing users with a holistic approach to managing their finances wisely.

Conclusion

Finanzguru.de empowers individuals to take charge of their financial futures with user-friendly tools and actionable insights that lead to tangible results. By incorporating this app into your daily financial practices, you, too, can unlock your financial potential and navigate your journey with confidence.

Ready to see the difference? Visit finanzguru.de to start transforming your financial health today!

What’s your experience with financial management apps? Let us know below!