Unlocking Business Growth with EquityNet: The Best Equity Crowdfunding Platform for Startups

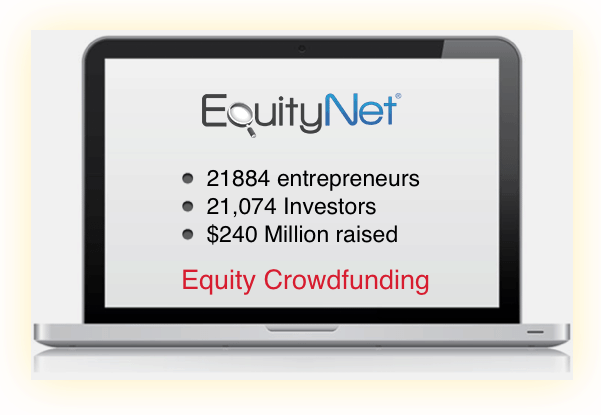

Have you ever wondered how startups secure the vital capital that fuels their growth? Or maybe you’ve thought about investing early in promising companies but felt overwhelmed by the complexity and risks? In the modern landscape of business financing, equity crowdfunding has emerged as a game-changing solution. But with so many platforms out there, how do you find the best equity crowdfunding platform that truly supports both startups and investors? This is where EquityNet steps in.

EquityNet is more than a crowdfunding site — it’s a comprehensive funding platform designed to bridge the gap between ambitious entrepreneurs and forward-thinking investors. Using cutting-edge technology and a robust analytical framework, EquityNet empowers businesses to raise capital efficiently, while providing investors with deep insights to make informed decisions. Intrigued? Let’s dive into how EquityNet is reshaping the equity crowdfunding space.

How Can Startups Maximize Their Fundraising Potential?

Navigating the fundraising maze is often challenging for startups. EquityNet provides actionable tools and industry insights that make this journey clearer and more achievable:

1. Craft a Clear Business Blueprint

EquityNet encourages startups to develop and submit detailed business plans, including financial projections and risk assessments. This transparency builds trust and makes the offering attractive to investors.

Example: A tech startup used EquityNet’s interactive business plan tools to outline a five-year growth strategy, capturing investor interest and ultimately raising over $500,000.

2. Utilize Automated Investment Matching

One unique feature of EquityNet is its patented investment-matching technology, which automatically connects businesses with investors whose interests and criteria align.

This targeted approach accelerates fundraising by reducing guesswork — rather than broadcasting to a general crowd, startups find precisely the right backers.

3. Leverage Comprehensive Analytics

EquityNet’s platform offers detailed analytics on market trends, competitive benchmarks, and funding performance. Startups can track their progress in real-time and adjust strategies accordingly.

Ever thought about how insightful data can pivot your fundraising approach? EquityNet arms startups with this very power.

4. Broaden Reach Without Sacrificing Control

EquityNet supports private meetings and communications, letting startups negotiate terms directly with investors. This balance of openness and control enhances deal quality and protects business interests.

5. Emphasize Compliance and Legal Confidence

Fundraising involves regulatory hoops. EquityNet’s service integrates compliance checks and guidance to ensure transactions meet legal standards, minimizing risk.

Are you curious how compliance simplifies fundraising for startups? EquityNet’s intuitive platform demystifies this vital aspect.

A Startup’s Journey: From Idea to Funding with EquityNet

Imagine Emma, a passionate entrepreneur with a vision for sustainable packaging solutions. She was eager to grow but struggled to find investors familiar with her niche. Traditional avenues felt slow and opaque. Then she discovered EquityNet.

Emma uploaded her detailed business plan onto the platform, highlighting her innovative biodegradable packaging technology. EquityNet’s investment-matching algorithm connected her with several impact-focused investors within days.

Through the platform’s communication tools, Emma negotiated flexible terms and received expert advice on financials and compliance. Within two months, she secured her initial $750,000 funding round — more than she anticipated.

Beyond capital, EquityNet offered Emma clarity and confidence. The transparent analytics showed her market potential and helped her strategize expansion. It wasn’t just about money; it was about empowerment.

This story might sound familiar to anyone facing the rigors of startup fundraising. How do you typically approach finding investment? Could a platform that combines technology with expert insights be the game-changer you need?

Strengths & Minor Shortcomings of EquityNet

✔ Advantages | ✘ Disadvantages |

|---|---|

| ✔ Innovative Funding Matching: Patented technology to match startups with fitting investors efficiently, saving time and boosting success rates. |

✔ Transparency & Analytics: Rich data and benchmarking tools for clear, actionable insights empower users to make informed decisions.

✔ Comprehensive Compliance Support: Built-in regulatory guidance reduces risk, making fundraising smoother and legally sound.

✔ User-Friendly Platform: Intuitive and robust interface suits both novices and seasoned entrepreneurs or investors.

✔ Wide Investor Network: Access to a diverse pool of early-stage and impact investors from various industries and geographies. | ✘ Premium Pricing for Certain Services: Some advanced analytics or consulting services have higher fees, which might be a consideration for very early-stage startups.

✘ Learning Curve: New users may take some time to fully leverage all platform features, necessitating initial patience.

✘ Limited Public Campaign Exposure: Unlike open crowdfunding platforms, EquityNet focuses more on targeted matching, which may limit the ‘buzz’ effect some startups seek. |

Are these disadvantages deal breakers? Many users find that the platform’s strengths substantially outweigh these minor drawbacks, especially when considering long-term growth and quality of investor connections.

Real Voices: Customer Testimonials on EquityNet

1. Sarah M., Founder of HealthTech Startup

“EquityNet’s matching system connected me with investors genuinely interested in healthcare innovation, cutting months off my fundraising timeline. The transparency and tools helped me present my vision with confidence.”

2. James L., Angel Investor

“I appreciate how EquityNet offers clear analytics and filtering, so I can quickly find startups aligned with my portfolio. It saves me from endless research, making investment decisions smarter.”

3. Ana P., CEO of Eco-Friendly Packaging Company

“The compliance tools on EquityNet gave me peace of mind. I wasn’t an expert on securities law, but the platform’s guidance was invaluable.”

4. Mark D., Startup Mentor

“I recommend EquityNet to startups because it balances tech innovation with real personal support. It’s more than just a website; it’s a partner in growth.”

5. Priya K., Social Impact Entrepreneur

“The platform’s investor matching helped me find backers focused on sustainable businesses, something hard to do with other crowdfunding sites. It felt tailored, not generic.”

Does hearing these experiences make you wonder how EquityNet could fit into your own business or investment journey?

Exploring EquityNet’s Broader Benefits and Use Cases

EquityNet is versatile, serving diverse needs beyond typical startup fundraising:

Accelerators & Incubators: Programs can use EquityNet’s tools to vet and showcase their cohorts, improving exposure and investment opportunities.

Small and Medium Enterprises (SMEs): Businesses seeking growth capital beyond seed stages find EquityNet a reliable partner for diverse funding rounds.

Non-Tech Industries: Unlike some platforms that focus narrowly on tech, EquityNet supports manufacturing, retail, health, and other sectors.

Investor Education: Novice investors gain access to learning materials and risk assessment tools that demystify equity investing.

- Corporate Innovation: Larger corporations exploring startup partnerships or acquisitions track emerging companies using EquityNet’s data.

Have you considered how your business might leverage a platform that adapts to different fundraising and investment stages? What untapped potential could EquityNet unlock for you?

Wrapping It Up: Why EquityNet Should Be on Your Radar

From innovative fundraising technology to a trustworthy, data-driven ecosystem, EquityNet offers a compelling solution for startups and investors eager to grow with confidence. If you’re searching for the best equity crowdfunding platform to transform your capital-raising or investing experience, finding that balance between transparency, technology, and support is critical.

Imagine a platform where your business story meets its perfect financial match, streamlined and smart — that’s EquityNet.

Ready to see the difference? Intrigued? Find out why it’s a must-have at EquityNet.com.

Interactive Prompt

What’s been your biggest challenge in fundraising or investing? Have you tried equity crowdfunding before? Share your thoughts and experiences below — we’d love to hear from you!

![EquityNet Review [2025] - Gold IRA Blueprint](https://goldirablueprint.com/wp-content/uploads/2024/04/equitynet-review-Hi.jpeg)